CASE STUDY

TrimTabs Asset Management

Challenge

The original TrimTabs Float Shrink ETF, TTFS, an actively-managed, free-cash-flow centric fund, was an unqualified success story, consistently outperforming its benchmark month after month. After such a positive track record, and after earning a Five Star Morningstar rating, it was a major shock when TrimTabs was unilaterally replaced as the subadvisor of the fund it had worked so hard to build up over the years.

Arro faced the challenge of protecting TrimTabs’s reputation during this tumultuous time, as they re-grouped and focused on re-launching their proprietary strategy under a new ticker: TTAC.

Solution

Arro focused on securing key interviews at leading financial publications, including ETF.com and Barron’s, that made sure to tell our client’s side of the story. More stories followed in ETF Trends, ETF Express, ThinkAdvisor, and Wealth Adviser. This effort allowed TrimTabs to take control of the media narrative, generating a positive story leading up to the re-launch of the strategy under the new ticker, TTAC.

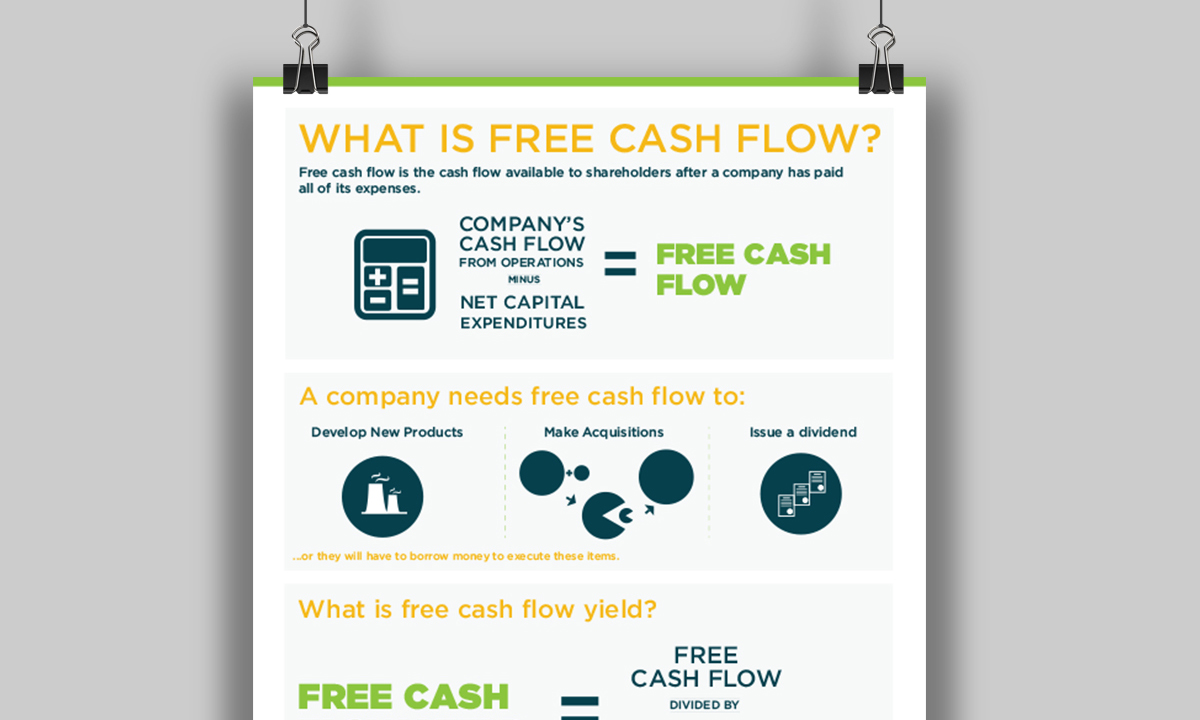

Arro also positioned TrimTabs spokespeople as experts on free cash flow, a metric that has been gaining in popularity among the investment community.

Results

TrimTabs’s relaunched fund, TTAC, has garnered more than $159.4 million in assets under management as of 1/25/23.