Google is famous for its Year in Search wrap-up videos (if you haven’t caught 2021’s yet, we highly recommend it.). And search traffic in 2021, did not disappoint. In fact, HubSpot claims that for 2021, Google controlled a little more than 92% of the search engine market share worldwide.

It’s estimated Google processes approximately 63,000 search queries every second, translating to 5.6 billion searches per day and approximately 2 trillion global searches per year. The average person conducts between three and four searches each day. That includes 72% of the desktop market and 92% of the mobile search engine market.

How many of them landed on your site? Not just that, how many engage for longer than a minute? How did your organic search traffic compare in 2021 over the previous year?

Well, in the investment management and financial services industry or if you were a mutual fund or ETF issuer coming off a big bump in 2020, chances are you saw some slippage.

In this 2021 Investment Management Search Engine Optimization (SEO) Update, the crew of digital superheroines and superheroes at Zero Company Performance Marketing break down:

- 2021 SEO ETF Search Traffic Results

- 2022 SEO Must-do’s

2021 SEO ETF Search Traffic Results

Zero Company looked across the industry, dove into the analytics and crunched the numbers. The results? For those sites we don’t do Professional SEO Services work for, the average ETF issuer saw its traffic down 30%!

We knew heading into 2021 that consumption for news and information on ETFs might slip a little. The pandemic hit in 2020 and put a lot of focus on investment information.

For our SEO clients, we saw a huge increase in 2020 — organic traffic was up 173% over the previous year. Their sites were primed and prepped for content consumption and when the spike hit, they saw massive gains. For non-clients, the industry saw a modest 9% increase in 2020.

The wave hit in 2020, and like a wave, it receded back into the ocean in ‘21. Still, our SEO clients saw on average a positive 19.5% increase. We’ll take it, especially since we gained on top of that massive wave.

2022 SEO Must-do’s

So, what should you focus on in 2022 to improve your organic results?

SEO Optimized Content

As always, content will remain king. Good content, properly optimized, will rule the day. Make sure you are producing unique content for your sites, first and foremost. High-quality content gets shared. And shared content produces SEO signals.

Backlinks from Other Sites

Backlinks will still play an influential role. Getting links back to that content (or your site in general) is still a key signal for the search engine algorithms. You want buzz to show you’re an authority on your niche.

ETF Specific Keywords

Your content should be using keywords that are important to your ETFs. The search engines are doing a better job of figuring out how keywords relate to one another (the technical term is latent semantic indexing – visit us to learn more about latent semantic indexing for your etf digital marketing.). They are understanding your content better. However, it’s still important to make sure key elements of your pages and content are keyword-focused.

Site Speed & Mobile Experience

Over the past few years, Google has put a much stronger emphasis on the mobile versions of your site. How fast and how well it renders is an important aspect of SEO that many people overlook. In fact in June 2021, Google did a big Core Web Vitals roll out emphasizing mobile page experience and again in November did another 2021 update on mobile-indexing.

For our ETF clients, you name it, we probably run a campaign for it. We develop a lot of paid search and social campaigns. We run programmatic display ads, native ads, video ads. Of all the tactics, when you look at it from a cost-per-click (CPC) standpoint, SEO usually produces the most bang for your digital marketing dollar.

Consider that good, high-quality traffic in the ETF space typically costs $2-$4 per click on the paid search platforms. It’s said the average click across all industries costs about $2.34 per click. It’s not unusual for your SEO expense to cost you a tenth of that amount for organic traffic increases over your current level.

During the pandemic, we saw the incremental SEO traffic at 1/100th of the cost per click for some of our SEO clients. That adds up, especially for the clients who had increases in the hundreds of thousands of site visitors. They were primed and ready for the increase in financial news consumption — for every $1,000 invested in SEO increases, some saw $100,000 incremental traffic increases!

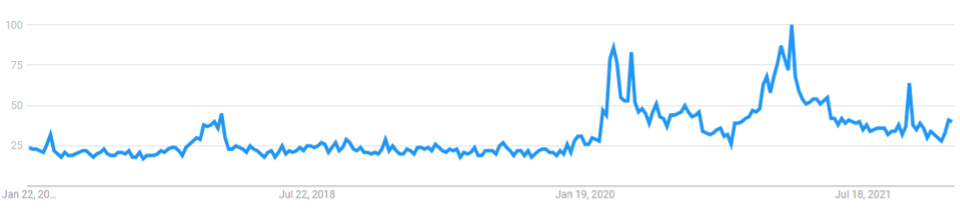

If you were like most ETF issuers last year and saw that 30% decrease, just note that search traffic is still humming at an elevated level. Here’s a Google Trends snapshot of the word “ETF” over the past 5 years:

Google Trends Snapshot – Keyword “ETF” Over 5 Years

As you can see, the interest spiked when the pandemic hit, and it has still stayed at high levels compared to pre-pandemic years.

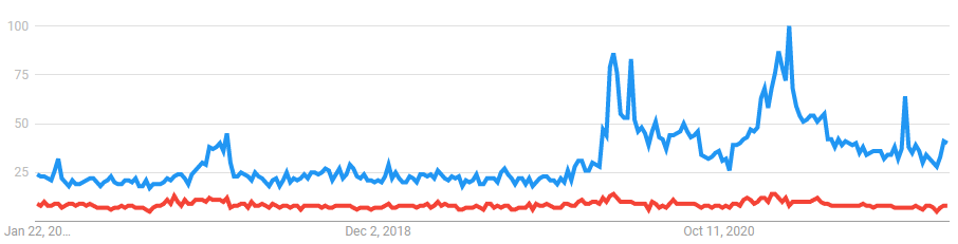

By the way, here’s that same graphic now compared to the word “mutual fund.” ETF issuers were reaping the rewards.

Google Trends Snapshot – Keywords “Mutual Funds” vs “ETF” Over 5 Years

Something we’ve noticed while marketing ETFs over the past decade is these high-interest events are typically also high conversion events. Professional and retail investors alike are making decisions with their investments and buying ETFs based on their online research.

In 2022, is your site going to be optimized for this traffic? If you need guidance, specific insight or help, now is the time to contact the team at Zero Company Performance Marketing and get started. They’ve made it simple for quite a number of ETF issuers.

If you need help executing any of the SEO elements discussed here, get in touch today (before a competitor does)! Our team of ETF digital marketing advertising experts would love to help you market your firm’s funds, services or investment approach to drive AUM growth. It’s easy. Get in touch here.

Schedule a Demo